China's lithium consumption is expected to slow down slightly in April from March amid high raw material prices and pandemic-led disruptions, industry sources said March 14.

Not registered?

Receive daily email alerts, subscriber notes & personalize your experience.

Register Now

China is currently facing a severe pandemic wave, the worst in two years, bringing logistical operations and consumption to a screeching halt.

Demand from cathode material producers has slightly decreased due to expensive raw material and reduction in orders from power battery makers.

Some vehicle makers in China were forced to cut or slow down production due to transportation hurdles and shortage of auto parts.

Nio — one of the leading producers of new energy vehicles in China — halted production due to the supply chain breakdown of auto parts, the company said April 9.

Market chatters indicated a major global EV maker in China stopped production from March 28 and was yet to resume production, but the company's spokesperson told S&P Global Commodity Insights he wasn't aware of any notice on the suspension of production.

Meanwhile, Faw-Volkswagen Automotive Co. Ltd. stopped its production in Changchun and Shanghai plants, Shanghai Securities News said in early April. S&P Global's calls to the company went unanswered.

Vehicle production in Shanghai and Jilin province — highly impacted by the new pandemic wave — accounted for 10.7% and 9.1% of the country's total production, respectively, S&P Global's calculations showed.

As vehicle makers halt production lines, this would lead to a decrease in demand for power battery and related raw materials in April, sources said.

Nio, for example, is a major consumer of Contemporary Amperex Technology Co. Ltd. (CATL). CATL is China's largest power battery.

Battery makers and refiners are also experiencing logistics woes, with most of East China facing some sort of lockdown measures.

Shanghai has remained in lockdown since late March due to COVID-19 resurgence, which has also spilled over to neighboring cities.

Lockdown measures in China have weighed on its supply chains as transportation remains disrupted, while workers remain in isolation. As China adheres to a zero-Covid policy, some reports suggest lockdown measures could be extended into May.

Ningde city in the Fujian province, where CATL is located, escalated its control measures in mid-April to contain the spread of coronavirus.

CATL is making every effort to ensure continuation of market supply and lower the impact to the minimum, stated-owned Fujian Daily reported.

A salt producer in Jilin province also said that while production was going on as normal, transportation was a major issue, messing up delivery schedules to customers, sources said.

Likewise, many traders said it was difficult to sign deals during this time as they could not guarantee material delivery.

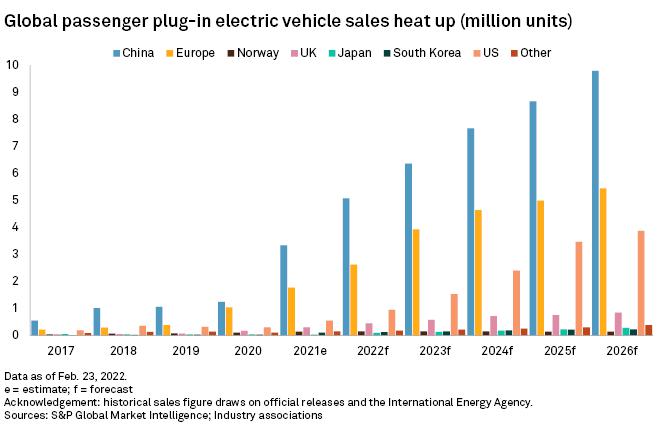

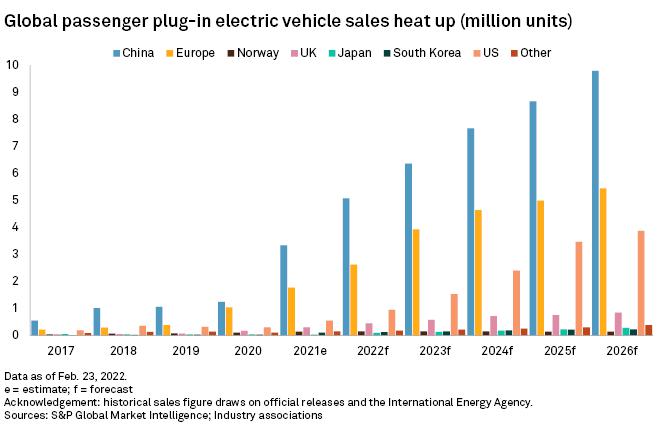

The explosive growth seen in China's EV industry sparked a race among suppliers to secure raw material, pushing up prices of lithium and nickel.

As a result, new energy vehicle manufacturers had to increase their vehicle prices to maintain their margins, as soaring lithium and nickel metals prices were passed on to downstream consumers.

The huge spurt in prices drew concerns from the China Association of Automobile Manufacturers (CAAM) and government authorities.

The unreasonable price hike of power-battery raw materials will impact China's new energy vehicle industry at a time it is eyeing expansion and subsidies have been also reduced, CAAM said in early April.

China's overall supply will not see a major gap as a key exporter for lithium chemicals, although 65% of the country's lithium resources relies on imports, CAAM said, underpinning its call for unjustified price hikes.

China's Ministry of Industry and Information Technology also held discussions in March, seeking details on the lithium industry and price hike of battery raw materials.

Emerging from maintenance period, Chinese lithium chemicals producers have recovered their output since February. Meanwhile, production from brine producers is expected to rise as the weather gets warmer.

Domestic producers are also expanding their capacity or putting new projects into production, sources said.

However, the latest developments are unlikely to boost domestic supply significantly in the near term, though current weak market sentiment would add some downward pressure on lithium salt prices.

S&P Global assessed battery-grade lithium carbonate at Yuan 475,000/mt ($74,612/mt) April 13 on a DDP China basis, down 6.9% from the record high reached on March 15.