Tesla (NASDAQ:TSLA) bulls are known for their outlandish valuation. Ron Baron, famed Tesla bull, has said he expects the company to move towards a 3-5x return in 10-years. Cathie Wood's 5-year forecast is $3000 implying a $3 trillion market cap.

As we'll see throughout this article, even with lofty estimations for cash flow, the company's weak position in the high-end EV and solar markets, along with capped growth rate in its other markets, will hurt its ability to generate continued shareholder rewards.

Tesla 1Q 2022 Results

Tesla had reasonable sales for the quarter, which saw strong YoY growth versus prior sales.

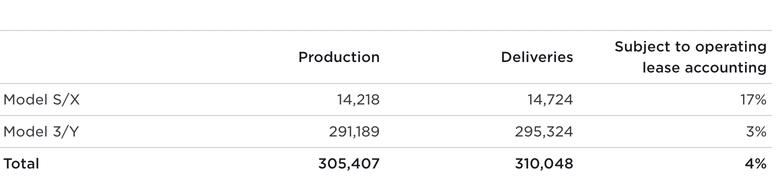

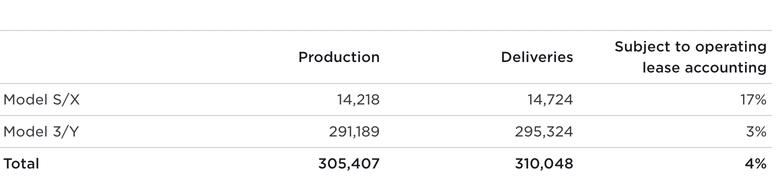

Tesla produced 305 thousand vehicles and delivered 310 thousand vehicles, for run-rate production of roughly 1.2 million vehicles annually. The company's Model S/X production and deliveries dropped to almost negligible levels, with 17% of the new vehicles subject to lease accounting. For the most part, until a new model is released, the high-end side of the business is dead.

The company's new Roadster could have helped to revitalize this side of the business, however, there's no sign of it coming out anytime soon.

Tesla Vehicle Business

In our view, the company's vehicle business is broken out into (4) parts. First is low-cost vehicles (Model 3/Y). Second is high end Ferrari-esque vehicles (Roadster). Third is mid-high-end vehicles (Model S/X). Fourth is self-driving and the company's efforts there.

We're not going to go in order but we'd like to discuss each one.

The company touted the next Roadster to substantial fanfare. The date has been consistently pushed out and the current estimated date is 2023. Whether it'll actually happen in 2023 remains to be seen, Tesla has a history of missing its dates. However, until something happens, the business is irrelevant to Tesla.

Next is the company's Model S and X. In our view these models are what made Tesla the company that it is today. However, the company hasn't seen strong performance in a significant amount of time, and at this point, sales are a very small part of the company. They are just a few billion $ annualized for the company.

The company refreshed the models recently, however, that hasn't made sales non-negligible by volume. We think, especially with additional top-of-the-line competition in the EV space from other companies Lucid (LCID), Rivian (RIVN), BMW (OTCPK:BMWYY), etc., we don't see this situation improving significantly.

Next is self-driving. Similar to the Roadster, we think the opportunity here is mostly smoke. The most analogous business we can think of Meta's (FB) meta-verse business. Could the market someday be huge? Sure. But until that point, we don't know if and when it's going to exist and if it does exist whether Tesla will have a reasonable market share.

Tesla has consistently pushed back its full self-driving date angering customers who are expecting it sooner after buying expensive packages. Fundamental design decisions in the company's approach like the lack of LiDar, or testing on consumers have not only cost the company cold hard cash but could result in it not ever beating out its competitors.

Again, we're not saying Tesla won't win here. But how much valuation are you willing to assign to that. Maybe Waymo, which has seen its valuation drop from $200 billion to $30 billion, could be a good benchmark here. We'd say it's a stretch to give Tesla's self-driving a valuation double that of Waymo ($60 billion).

Lastly, we get to the Model 3/Y. At this point, these low-cost models represent the core of Tesla's business. They represent the vast majority of production growth and volume is at more than 1 million vehicles/year. These businesses are a behemoth by themselves. EV competition is rapidly increasing, but so far, from the larger brands, the competition has been higher end.

The company is expected to exit 2022 with run-rate production, primarily from these vehicles, at more than 2 million vehicles/year. We see Tesla as moving towards a mass-market manufacturer here, with increased competition. Toyota is a potential metric here in reliable low-cost vehicles, as the leader there, with 10 million annual vehicle sales and a $280 billion market cap.

It should be noted even with a 50% annual growth rate there's a wide gap between 2 million vehicles/year and 10 million vehicles/year. All the way to 2028 at 50% annualized growth.

Tesla Alternative Business

Tesla is focused on several different alternative businesses, primarily in energy storage and solar.

Tesla's alternative businesses are energy storage and residential solar. The residential solar business especially has struggled and has just a few % market share. With a 2% market share, the business hasn't kept nearly the pace of the overall solar market. The roof solar business seems yet to generate a sizeable business.

The company is looking to increase profitability here, however, at 345 MW in 2021 residential solar and $2-3 million per MW in deployment costs what you have here is an incredibly competitive business where Tesla has no useful market position and $1 billion in low-margin revenue.

The company's energy storage business definitely has more potential. The company has had much more consistent growth and moved to roughly 4 MWh deployed. Its megapack system is unique in a world where battery demand is growing rapidly. Tesla charges roughly $300/Kwh in the last revealed prices, implying roughly $1 billion in revenue here as well.

This is a business we could see Tesla doing well in for the long run. However, we don't think it's a company maker on the trillion-dollar scale. Margins are tight and IP protection is thin in this business. Demand is expected to reach towards 1 Twh by 2030. If Tesla has a 100% market share that's $300 billion in revenue.

However, there are three things worth noting.

(1) By 2030 storage costs will likely be less than $150 per Kwh. It could go down even further. That alone is a >50% cut in the estimate.

(2) Tesla currently has a 7% market share in the industry. The chance of turning that to 100% market share by 2030 is near 0. Over the past 2 years, the company's market share has increased by roughly 2%. From manufacturing alone, the company wouldn't be able to build factories fast enough even if the demand was there.

(3) The margins are much lower. Tesla has redirected batteries from this segment to vehicles because they have higher margins. Tesla has said it wants higher margins in the megapack business, but the net margins will likely stay in the single digits.

Still, it's a respectable business.

Our View

Let's take a look at the Tesla of 2030. Most bullish metrics are for a $3-6 trillion market capitalization by this time. Note that a $3 trillion market cap (tripling in stock) would represent roughly 13-14% annualized growth which is strong but not dramatically better than the historic S&P 500 returns.

Let's even skip the timeline given by the bullish thesis and look at what it would take the company to hit a $5 trillion valuation. For a company to hit a long-term $5 trillion valuation at some point the FCF needs to cross the point to justify that valuation. It might not be at that point when the company specifically hits the valuation but it needs to have a path there.

We view an 8% FCF yield as that threshold for static growth ($400 billion in FCF). We will not adjust for inflation because we presume investors don't want a company that hits a 5x market cap just because inflation eventually makes the dollar worth 1/5 as much.

The company has several businesses that we will attempt to value.

(1) Self-driving

(2) Energy storage

(3) Residential solar

(4) High-end vehicle

(5) Mass-market vehicle

For self-driving, there's an incredibly wide range of valuations and an incredibly wide range of outcomes. Conceivably the range could go from $0 to hundreds of billions. We think the most generous valuation is the peers. Cruise is valued at $20 billion a drop from 2021. Waymo is at $30 billion down from $200 billion 1-2 years before.

In our view, the most generous valuation is $5000 profit per vehicle sold, assuming the company achieves it, multiplied by 5 million annual vehicles sold. That's $25 billion in FCF. At our 8% yield that means we're assigning $300 billion to the self-driving business or 10x what Waymo's current valuation is.

Energy storage is another business. The company has a 7% market share and we'll give the company the benefit of the doubt of tripling that almost to a 20% market share over the upcoming years and decades. Given the company's strong success some might argue it's too low, but it's an industry that's never had a significant moat.

We'll also give a 20% margin. By 2030, assuming $150/Kwh that means $6 billion in FCF with $30 billion in revenue. We'll be even more generous and double this. That's $12 billion in FCF.

For residential solar, this is one of the least valuable businesses in our view. We'd argue that SolarCity and Tesla solar are worth less standalone, due to a lack of interest than it was at the time of the $2.6 billion acquisition several years ago. The company has a 2% market share of an incredibly competitive business. We'd say best $1 billion in FCF which would imply dramatic growth.

Moving onto the high-end vehicle business we're looking at EVs like the Roadster and even the Model S/X. Once again we think the best way to value this business is versus the earnings of its peers. A high-end premium business could be worth as much as Mercedes combined with BMW or roughly $30 billion in FCF in an incredibly strong recent year (or $375 billion in our value).

That's versus their current combined market cap or roughly $130 billion.

Lastly, we get to the mass-market value. Here we'll give what we believe are some generous assumptions. We'll assume 20 million in annual vehicle sales as a peak, twice the current largest car manufacturer, while still achieving a $50 thousand per vehicle ASP. We'll also assume 20% margins, better than all other car makers.

In our view, those are some lofty targets. The revenue would be $1 trillion annually generating a massive $200 billion in FCF. For perspective, the entire auto industry (not just cars but trucks. etc.) is expected to hit $3.8 trillion in annual revenue by 2030 versus roughly $1 trillion less than that today.

Even putting these 5 numbers together, that's $268 billion in annual FCF or roughly 65% of what the company needs in our book to justify the bull case. These are some incredibly lofty targets in our view and unrealistic by nearly every account. It assumes Tesla not only dominates but continues growing with no competition.

It's also worth noting that in Tesla's first two businesses where serious competition has come along (residential solar and high-end EVs) the company has dramatically lost market share. In our view this highlights, the risk of the company's ability to hit the bull thesis.

Thesis Risk

The risk to our thesis is that Tesla has outperformed all expectations. The company continues to see its share price increase and its definitely managed to keep up its growth much faster than we thought was possible. There's definitely the chance that the company continues to grow and learns to compete more effectively increasing shareholder returns.

The next major risk to the Tesla thesis is competition. As technology has shown decade after decade, in industries like silicon manufacturing, computer building, etc., the company that proves the industry often isn't the one that keeps its market share. This is already evident through the Model S/X where competition has increased dramatically.

We expect, over the coming years, this will become increasingly true in the energy storage and low-end EV businesses, hurting Tesla's position in these industries.

Conclusion

Tesla bullish investors continue to forecast market-beating returns. That's despite the company's cross into a $1+ trillion valuation. Despite the ability of other companies, such as Apple, to continue growing from this level, we think that Tesla with its lack of substantial FCF and a path to shareholder rewards will struggle heavily.

The company has several businesses, however, outside of energy storage and the Model 3/Y we don't see any of the businesses as significant. For those businesses, we don't see a path for them to justify Tesla's valuation hence our current recommendations with the company's earnings to avoid investing in Tesla.