O Global Times Business Reporter que cobre setores de espaciais com TMT, automóveis e comerciais.

Zhang HongpeiPublished: Mar 20, 2022 05:57 PM

Os clientes testam em uma loja da Tesla em Xangai em janeiro de 2021. Foto: VCG

A new wave of price hikes among new-energy vehicles (NEVs) is set to hit the Chinese market, yet it is unlikely to slow sales in the world's largest NEV market thanks to the robust domestic demand and resilient economic growth, industry analysts told the Global Times.

The rising costs of raw materials, in particular the key components of automobile batteries, have prompted an array of NEV producers including electric vehicle giant Tesla and its Chinese rivals to hike prices. Since the beginning of March, nearly 20 NEV companies have announced price hikes, impacting around 40 models.

Chinese NEV maker Xpeng said that starting from March 21, price increases on its vehicles will range from 10,100 yuan ($1,587) to 20,000 yuan before subsidies.

Xpeng's current models include the flagship P7 sedan, the P5 sedan and the G3 sports utility vehicle (SUV). Its new vehicle delivery in February stood at 6,225, down from 12,922 in January and 16,000 in December. XPeng said it used traditionally the slowest sales period of the year to retool some of its plants.

February is a traditional off-season for the auto industry in China, mainly affected by the Spring Festival holidays and a buying peak which typically comes before the holiday.

Chinese electric vehicle start-up WM Motor announced on Saturday that it will adjust the prices of models on sale as affected by factors such as the continuous sharp rise in raw material prices and tight capacity across suppliers. Prices increase will range from 7,000-26,000 yuan after subsidies.

Chinese electric vehicle maker BYD said last week that it will raise prices on its models by 3,000-6,000 yuan, also citing rising raw materials costs, a day after Tesla upped prices on its cars.

Among all the automakers that have announced price hikes, Tesla has the highest price increase frequency, adjusting pricing three times within seven days. On Thursday, Tesla raised the price for its cheapest Model Y made in China by 15,060 yuan, pushing the retail price to 316,900 yuan, following two consecutive price hikes for its more expensive versions within a week.

Tesla's Chief Executive Officer Elon Musk said that the company was facing significant inflationary pressure in raw materials and logistics.

Rising costs

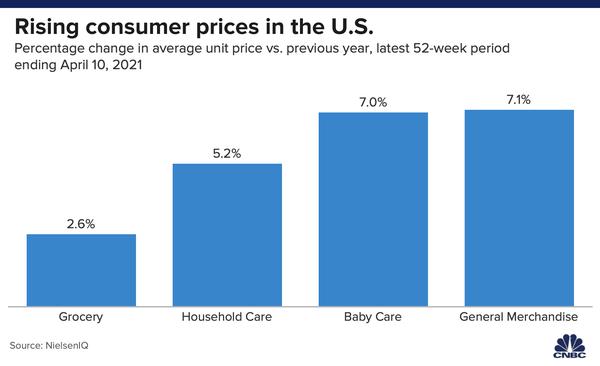

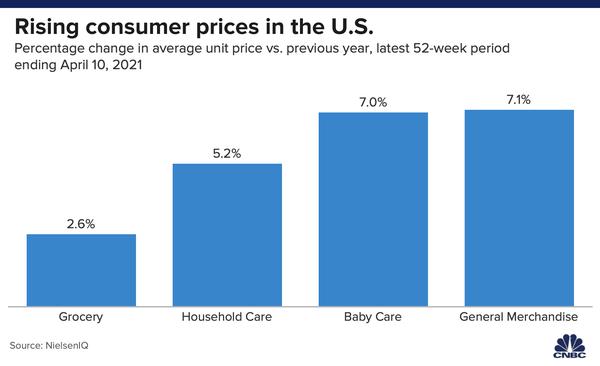

Different from the previous wave of price hikes mainly due to the reduction of subsidies - a scheme first introduced in 2009 to help cultivate China's nascent NEV sector, this new wave is highly related with the sharp rise in costs of raw materials, in particular key components used to manufacture automobile batteries, such as nickel and lithium.

In terms of costs, compared with bulk raw materials, prices hikes of batteries are more of a direct factor, according to an analysis report by investment bank CICC.

Taking lithium as an example, its price has increased tenfold in more than a year from 50,000 yuan per ton in early 2021 to the current 500,000 yuan per ton. On Friday, domestic price of lithium carbonate registered at 504,000 yuan per ton, an increase 479.3 on a yearly basis.

"The price increase of raw materials for NEVs is a cyclical behavior, and carmakers are upping their prices in response, which is market-driven," Cui Dongshu, secretary general of the China Passenger Car Association, told the Global Times on Sunday.

He estimated that it would take some time for raw material costs to return toward typical levels, maybe a year at most.

The sharp increase in the supply chain costs has even forced some car producers to suspend production and sales of their popular best-selling models.

Two models of Ora, an electric vehicle brand which belongs to Chinese automaker Great Wall Motor, have suspended new orders since late February, since the surging raw material costs would cause a single model's losses to exceed 10,000 yuan.

The mounting pressure clouding NEV makers' upstream markets have been noticed by Chinese authorities.

On late Friday, China's Ministry of Industry and Information Technology (MIIT) said in a meeting that the upstream and downstream enterprises in the industrial chain should strengthen connection between supply and demand, work together to form a long-term and stable strategic cooperative relationship, and jointly guide lithium prices toward sustainable levels.

Sales to be unaffected

As multiple NEV makers have transferred some raw material cost pressure onto buyers, it has sparked market concerns whether it would dent sales this year. As experts and industry research pointed, NEVs still appeal to domestic consumers especially at the moment when retail prices of gasoline and diesel are soaring for traditional internal combustion cars.

As of Friday, retail gasoline prices will rise by 750 yuan a ton and diesel prices by 720 yuan a ton, the National Development and Reform Commission said.

An analysis research by Sinolink Securities showed that consumer sentiment remains strong. In spite of high prices of lithium and oil, the attractiveness of electric vehicles to consumers has not weakened.

"Consumers actually have reasonable expectations about the sales price hikes amid the inflation. Currently, we can see many consumers have to wait for even several months for some hot-selling models, which reflects vibrant consumer activity," Cui said.

He believed that the year's NEV sales won't be affected by the current wave of price hikes, noting that the CPCA maintains their previous forecast of sales by 5.5 million units in 2022.

China's NEV sales came in at 3.52 million units last year, data from the MIIT revealed, ranking first globally for a seventh straight year in 2021despite economic uncertainty and supply chain pressure.

RELATED ARTICLES Retail sales of NEVs in 2021 up 169.1% y-o-y

As vendas de varejo da China de novos veículos energéticos (NEVs) de janeiro a dezembro em 2021 chegaram a 2,989 milhões de unidades, ...

Tech giants eye NEV growth

O desenvolvimento da nova indústria de automóveis energéticos está em pleno andamento, e mais empresas estão se juntando ao ...